I put two children through Harvard by trading options. Unfortunately, they were my broker’s children.

JASON ZWEIG AMERICAN JOURNALIST

Welcome to our May newsletter – the fact that May has arrived tells us that we are less than two months from the end of the financial year, and also heralds the pending arrival of this year’s Federal Budget which will be handed down on Tuesday 11 May.

We’ll talk about that more after we know what’s in it. Just keep in mind there will be leaks aplenty before budget day and some will be correct and some will not. The Catch-22 is that the devil is in the detail and it’s only when we get the huge amount of information emailed to us by fund managers on budget night that we find out what sneaky stuff never made it to the press.

In this newsletter we focus on preparing for June 30 because there are often many things people can do to improve their financial situation – BUT most of these strategies cannot be put into place once June 30 has passed. I appreciate that it contains some technical stuff but that’s the way the laws work. If it doesn’t apply to you just move on.

All my life I’ve been urging investors to take a long-term view. Just think about this extract from my newsletter of April last year – that’s just 12 months ago:

Noel News April 2020:

“And, of course, the newspapers are now featuring headlines like “property may drop 30%” which is nonsense because every property is different – some will drop and some will stay static. But all this argy-bargy between governments, landlords, and tenants highlights the difficulty of owning residential property when the going gets tough.”

1 March 2020:

And this:

Noel News April 2020:

“Retirees suffered another blow recently with strong hints in the media that the big four banks may suspend all dividend payments for the next six months. As a result, I have received a flood of emails asking if that’s a real possibility…these are uncertain times, but I believe the worst that could happen is that dividends here may be suspended for six months, but then restored after that. And if that happens, the renewed dividend may well be bigger than expected.”

6 March 2021:

I am not telling you this to boast about being some kind of prophet. Having been in the investment business for more than 60 years I know that papers thrive on bad news, and that good times always follow bad. The big question now of course is how long is the current boom going to continue. Anyway, bank dividends are back with a vengeance.

Westpac Banking Corp pledged to reduce costs by $2 billion by 2024, as it reported interim cash earnings of $3.5 billion, up 256 per cent on the provision-hit first-half of last year, as the economy rebounds quickly from COVID-19. Westpac’s cash earnings came in higher than analysts’ expectations, and so did the interim dividend of 58¢ per share. Westpac reinstated its dividend and is paying out 60 per cent of its profits, after deferring its first-half dividend in 2020 before electing not to pay one, and in 2019 paying out 94¢ a share.

You can bet all the other banks will have a similar results.

Preparing for June 30

This has been a most unusual financial year, and your income may be way down. If that’s the case, it may be valuable to postpone personal concessional deductible contributions to superannuation, or repairs and maintenance on investment properties, until a year when your earnings put you in a higher tax bracket, when the deduction would give you a higher refund.

If you have some shares with a capital gain, and some with a capital loss, take advice about whether to sell both before 30 June to offset the gain against the loss. Also, if there is likely to be some CGT payable, if you are in a lower tax bracket this year, the CGT may be charged at a lesser rate.

Making superannuation contributions up to your maximum cap of $25,000 a year is a no-brainer. Once you have reached that cap, consider making a contribution for your spouse. If they earn less than $37,000 this financial year you may even get a tax offset as a bonus. Get advice on your particular circumstances, as this tax offset is unlikely to be a better option than making a deductible contribution for yourself. To qualify for the spouse contribution tax offset of $540 all you need to do is make a $3,000 non-concessional contribution, on their behalf. Your spouse may also like to consider making a non-deductible super contribution for themselves of $1,000, if they are eligible for a $500 government co-contribution.

A re-contribution strategy is worthwhile if you have access to superannuation, and are still eligible to make contributions. You could possibly withdraw up to $300,000 tax-free, and re-contribute it as a non-concessional contribution, on which there would be no entry tax. By doing this you would convert a large chunk of the taxable component of your fund to non-taxable, and so alleviate substantial taxes for your inheritors if you died suddenly, and your superannuation went to a non-dependent.

Don’t forget the strategy of splitting your superannuation with your spouse. To be eligible, the receiving spouse must be under 65 and, if over preservation age, not retired. Where the receiving spouse turns 65 during the year of the split, you need to act before their birthday. The transfer must be completed by 30 June.

As long as the contributing member has a sufficient account balance, the amount that can be split is the lesser of 85% of that year’s concessional contribution or $25,000. This means that, if the contributing spouse has made a $25,000 contribution, the maximum split would be 85% or $21,250.

Take advice if you are under 67 and nearing retirement, because apart from the downsizing contribution, it may be your last chance to boost your superannuation. You could still use the bring-forward rule, which will allow you to contribute $300,000 as a non-concessional contribution, and so move funds to an area where tax will be zero once you start to draw a pension from your fund.

The key message in regard to contributions is to make sure they are paid on time. This is especially important if you use a clearinghouse by your employer because the fund could take up to 2 weeks to receive the payment. If the payment is received after June 30 it will count for next year. This could have serious impact on your financial affairs.

Make sure you take advice before you make tax-deductible contribution. It’s a minefield of paperwork, and getting it wrong could mean loss of all or part of the tax deduction. You have to submit a “valid notice of intent to claim a deduction for personal superannuation contributions in the approved form, to the superannuation fund trustee within the required timeframes”. You then need to receive an acknowledgement from the trustee that a valid notice of intent has been received, before you can claim a tax deduction. The timing of these actions in relation to your contribution and what you do next is important.

|

Voluntary super contributions such as salary sacrificed contributions or personal contributions other than downsizer contributions can only be accepted on or before 28 days after the end of the month in which the contributor turns 75 , subject to meeting the work test or work test exemption if above age 67.

Since the start of the current financial year, a person aged 65 or 66 is no longer required to meet the work test to make a voluntary super contribution. However, one they are 67 or over at the time of making a voluntary super contribution, they still need to meet the work test or work test exemption to be able to make a voluntary contribution (except for a downsizer contribution).

The work test requires you to be gainfully employed for at least 40 hours in 30 consecutive days in the financial year. Where required, the work test must be satisfied before the voluntary contribution is made.

These may be useful for people who wish to:

- build up their retirement savings in a tax-effective environment

- minimise the tax payable on their super death benefit by a non-tax dependant such as an adult child by implementing the “withdrawal and re-contribution” strategy

- equalise the super balances between spouses by taking lump sums or pension payments from the spouse with a higher super balance and contributing to the spouse’s super with a lower super balance

- maximise their Centrelink age pension payments by withdrawing from their super and sheltering the amount in their younger spouse’s super if the spouse is under their qualifying age pension age

The cap for NCCs is $100,000 a year in some cases the bring forward rule may be used to enable three years contributions to be made in one lump sum. Keep in mind that the cap rises $110,000 after 30 June so in some cases you may be better off to wait and contribute $330,000 after 30 June instead of $300,000 before it. The amount that can be contributed depends on your total superannuation balance and current rules prevent any non-concessional contributions if your balance is in excess of $1.6 million. It’s vital you take advice if you are thinking of using the bring forward rules because they are complex. All

If you are in pension mode now, keep in mind that the minimum drawdown requirements that were hard due to Covid in restored to take effect from 1 July 2021. Therefore, when working out your budget for the next financial year make sure your phone has enough cash to make the pension payments for you.

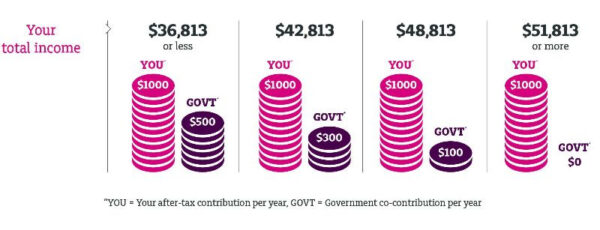

If your income (i.e. assessable income, reportable fringe benefits and reportable employer super contributions) is less than $54,837 and at least 10% of this income is derived from employment activities (including self-employment), you may be entitled to the government super co-contribution of up to $500 if you make a personal non-concessional contribution to super. The maximum co-contribution of $500 will apply where income is $39,837 or less and you make a personal after tax contribution of at least $1,000.

To be eligible you need to be under 71 at the end of the contributing financial year and if over 67, must meet the work test (or work test exemption) to be able to contribute.

The income used to calculate the amount of the co-contribution is the sum of the assessable income, reportable fringe benefits and reportable employer super contributions, less any amounts that the individual is entitled to claim as a tax deduction for carrying on a business.

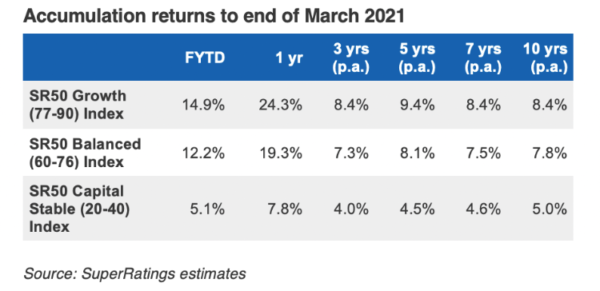

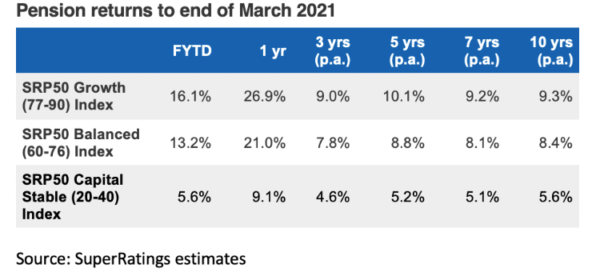

The remarkable recovery in super fund’s performance continues with another strong month of returns despite a slower vaccine rollout than many had hoped for and some regulatory uncertainty around the use of some vaccines.

According to SuperRatings data, the median balanced option rose an estimated 2.0% in March, while the median growth option rose an estimated 2.4% and the median capital stable option rose an estimated 0.9%. Over the 2020-21 financial year to date, the median balanced option returned 12.2%, reflecting the strength and speed of the post-pandemic recovery, which extended through to the end of the March quarter.

As Australia confronts the short-term effects of the pandemic, members should expect markets to remain volatile, but the theme of 2021 is certainly one of ongoing recovery as the jobs market improves and economic activity picks up once again.

Pension returns were also positive in March. The median balanced pension option returned an estimated 2.1% over the month and 13.2% over the financial year to date. The median pension growth option returned an estimated 2.5% and the median capital stable option gained an estimated 1.0% through the month.

With the critical JobKeeper support now at an end and banks requiring mortgages to be serviced after a brief hiatus for those in need, it remains to be seen what the immediate economic fallout will be, but so far households appear to be holding up well. The reason pension funds performed better than the accumulation funds is because accumulation funds pay 15% income tax, whereas pension funds pays zero tax.

And as I have stressed repeatedly, the amount of money you will have in your portfolio when you retire, and how long that money will last depends mainly on the rate of return you can achieve. This may be a good time to make sure your superannuation is in an appropriate asset mix for your goals and your risk profile.

This is covered in great detail in my new book Retirement Made Simple.

Charlie Munger has been Warren Buffett’s business partner for many years. He is now 97 and still going strong. This 10 minute video appears to have been shot recently, and gives us a wonderful insight into his views on how to be a successful investor. Highly recommended.

Rising life expectancies are proving a special challenge for baby boomers. Many of them are caught between a rock and a hard place: their kids won’t leave home and their parents won’t die. And to make matters worse, parents are often not limited to just two people –there may be four, or even more if blended families are involved.

The outcome for many baby boomers is that their parents become dependent, or at least reliant, on them — and not necessarily at the same times. This creates particular challenges for retirees in responding to their own needs and dealing with the complexity of the needs of various parents.

The challenges are wide-ranging, including both physical and mental health of the parents, and serious relationship breakdowns if a couple cannot agree on the best course of action for caring for the ageing parents of one or both of them.

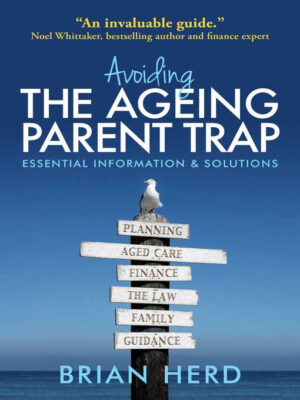

Elder lawyer Brian Herd, who I quote regularly in my question-and-answer columns, is an expert in this field, and has just released a brilliant book, The Ageing Parent Trap, which explores the myriad issues that can arise as parents get older.

Herd points out that most Australians have an aversion to confronting the future, let alone getting advice about it. At most, they will probably get financial advice on big events such as investing their superannuation when they retire, but few give much thought to funding their own aged care, much less planning and funding their parents’ aged care.

What I particularly like about The Ageing Parent Trap is that it is chock full of real-life examples of problems caused by omission and commission – some of which were solved easily and some of which caused ongoing problems.

A major problem is that life can change in a moment. Herd describes a typical situation – a man is going busily about his day when the phone rings and he hears those fateful words: “Mum’s had a fall and she won’t be coming home.” Suddenly, major issues leap to the fore: Where will she live? Who will take care of her? Where will the money come from?

And other issues may quickly spring to light. Children may be spread around the country – or the world. Some are keen to be involved; others are not. And they may have very different ideas about what the best solution looks like. It can quickly develop into a bunfight as siblings argue about what should happen next. These scenarios can lead to failed families, imploding relationships, and sometimes leave the parents hung out to dry while the children are fighting it out. Family mediation may be required.

It’s a grim scenario, but taking reasonable steps to prepare for it usually leads to significantly better outcomes for all involved.

Herd recommends the best place to start is with open dialogue among parents and their children about what should happen if the parents need help. This would include the parents preparing wills, enduring powers of attorney and advance health directives – and keeping them up-to-date. It may not be easy – many parents will be in denial about the need to discuss such issues. But conversations now can prevent all sorts of issues later; when the inevitable happens at least family members have a basis for agreeing on the best course of action.

Aged care is not free, nor is it simple. And it can be complicated, not just by the system, but by the parents’ circumstances. For example, they could be separated by circumstance if one needs to go to aged care and the other remains at home – as a result, their cost of living would almost double. Then, if there’s a family home, children face the classic conflict between preserving their inheritance on the one hand, and funding their parents’ aged care on the other.

Residential aged care is not an attractive option, and home care packages are rationed like hens’ teeth. The result is an increase in family care – families caring for parents, often with parents moving in with family members, or vice versa. This is a complicated legal financial and social dynamic with lots of tributaries, and is fraught with family cleavages.

I appreciate this is a difficult topic but it’s better to face it now than later. The reality is that many adult children will be forced, often urgently, into their ageing parents’ lives and often into their financial lives. It gives “family-planning” a whole new meaning. Herd’s book is a great resource to help you plan now to mitigate huge problems later.

The Ageing Parent Trap is available at most bookstores or online.

These are from the 70’s Hollywood Squares, when game show responses were spontaneous and not scripted like they are now.

Q: If you’re going to make a parachute jump, you should be at least how high?

A: Charley Weaver: Three days of steady drinking should do it.

Q: True or false…a pea can last as long as 5,000 years.

A: George Gobel: Boy, it sure seems that way sometimes.

Q: You’ve been having trouble going to sleep. Are you probably a man or a woman?

A: Don Knotts: That’s what’s been keeping me awake.

Q: According to Cosmo, if you meet a stranger at a party and you think he’s really attractive, is it okay to come out directly and ask him if he’s married?

A: Rose Marie: No, wait until morning.

Q: Which of your five senses tends to diminish as you get older?

A: Charley Weaver: My sense of decency.

Q: In Hawaiian, does it take more than three words to say “I love you”?

A: Vincent Price: No, you can say it with a pineapple and a twenty.

Q: Paul, why do Hell’s Angels wear leather?

A: Paul Lynde: Because chiffon wrinkles too easily.

Q: Charley, you’ve just decided to grow strawberries. Are you going to get any during your first year?

A: Charley Weaver: Of course not, Peter. I’m too busy growing

strawberries!

Q: It is considered in bad taste to discuss two subjects at nudist camps.

One is politics. What is the other?

A: Paul Lynde: Tape measures.

Q: When you pat a dog on its head he will usually wag his tail. What will a goose do?

A: Paul Lynde: Make him bark.

Q: If you were pregnant for two years, what would you give birth to?

A: Paul Lynde: Whatever it is, it would never be afraid of the dark.

Q: According to Ann Landers, is there anything wrong with getting into the habit of kissing a lot of people?

A: Charley Weaver: It got me out of the army!

Q: Back in the old days, when Great Grandpa put horseradish on his head, what was he trying to do?

A: George Gobel: Get it in his mouth.

Q: Who stays pregnant for a longer period of time, your wife or your elephant?

A: Paul Lynde: Who told you about my elephant?

Q: Jackie Gleason recently revealed that he firmly believes in them and has actually seen them on at least two occasions. What are they?

A: Charley Weaver: His feet.

Q: Do female frogs croak?

A: Paul Lynde: If you hold their little heads under water long enough.

I hope you have enjoyed the latest edition of Noel News.

Thanks for all your kind comments. Please continue to send feedback through; it’s always appreciated and helps us to improve the newsletter.

And don’t forget you’ll get much more regular communications from me if you follow me on twitter – @NoelWhittaker.

Noel Whittaker